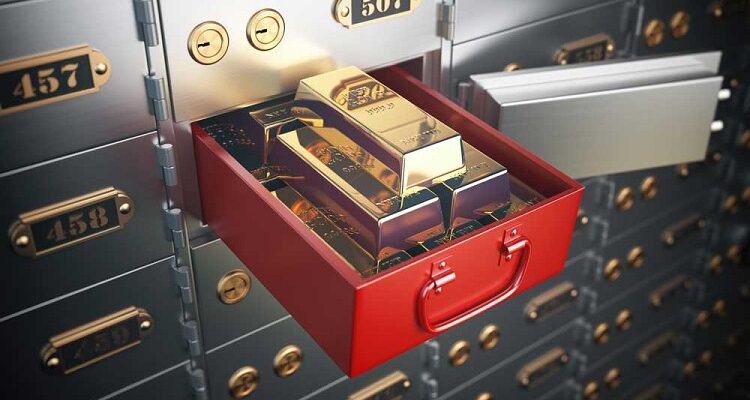

When it comes to investments, gold has always been a symbol of wealth and stability, attracting investors for its inherent value and resilience against economic fluctuations. However, the security of this precious metal is a paramount concern for investors, prompting the need for a reliable storage solution. Safe deposit boxes, offered by banks and various financial institutions, emerge as a premier choice for safeguarding gold investments. This guide explores why safe deposit boxes are considered the smart investor’s gold storage solution.

Table of Contents

The Enduring Value of Gold

Gold’s allure lies in its ability to maintain value over time, acting as a hedge against inflation and a safe haven in volatile markets. It’s a tangible asset that diversifies investment portfolios, providing a counterbalance to stocks and bonds. Yet, the physical possession of gold presents challenges, notably in its secure storage.

The Advantages of Safe Deposit Boxes

Unrivalled Security

Housed within the fortified vaults of banks, safe deposit boxes for your valuables offer security measures that are nearly impossible to replicate in a home environment. They benefit from advanced surveillance, alarm systems, and protection against theft, fire, and natural disasters.

Privacy Guaranteed

The contents of a safe deposit box remain confidential, accessible only to the box holder and their authorised representatives. This privacy is invaluable for investors seeking discretion in their gold holdings.

Environmental Protection

Safe deposit boxes provide a controlled environment that shields gold from potential environmental damage, ensuring the preservation of your investment over the years.

Selecting the Perfect Safe Deposit Box

Size and Space

Choosing the right size for a safe deposit box is crucial. It should accommodate your current gold investment and allow space for any future acquisitions. Assess your needs to find a box that suits your collection.

Cost Efficiency

Renting a safe deposit box is an economical way to protect your gold. The annual fee is a small price for the security and peace of mind it offers, mainly when weighed against the potential risks of loss or damage.

Access Considerations

Although secure, safe boxes are accessible only during bank hours. This limitation may affect investors who require immediate or frequent access to their gold.

Insurance Considerations

It’s important to note that bank insurance policies generally do not cover the contents of safe deposit boxes. Investors should consider obtaining separate insurance to cover their gold against unforeseen events, ensuring comprehensive protection.

Exploring Alternatives

While these boxes rank high for security, other options, like home safes, might offer more immediate access. However, they may not provide the same level of protection against external threats as bank vaults.

Gold Storage Best Practices

Document Everything

You should maintain an updated record of your gold investments, including detailed descriptions and photographs, for insurance and personal reference.

Evaluate Accessibility

If access is a key concern, consider how the bank’s operational hours align with your needs. The trade-off between security and accessibility is crucial.

Diversify Storage Methods

For large gold portfolios, diversifying storage methods can enhance security. Combining safe deposit boxes with other storage solutions, like home safes, might offer a balanced approach to protection and accessibility.

Looking Ahead: The Evolution of Gold Storage

New storage solutions, including biometric security and digital safes, are emerging as technology advances. Despite these innovations, the conventional safe deposit box continues to be favoured for its proven reliability and security.

Conclusion

Safe deposit boxes offer an ideal solution for gold investors seeking secure storage. They ensure unparalleled security, privacy, and environmental protection, catering perfectly to the discerning investor’s requirements. By selecting the right safe deposit box, considering extra insurance, and following best storage practices, investors can efficiently protect their valuable gold assets.

Comments